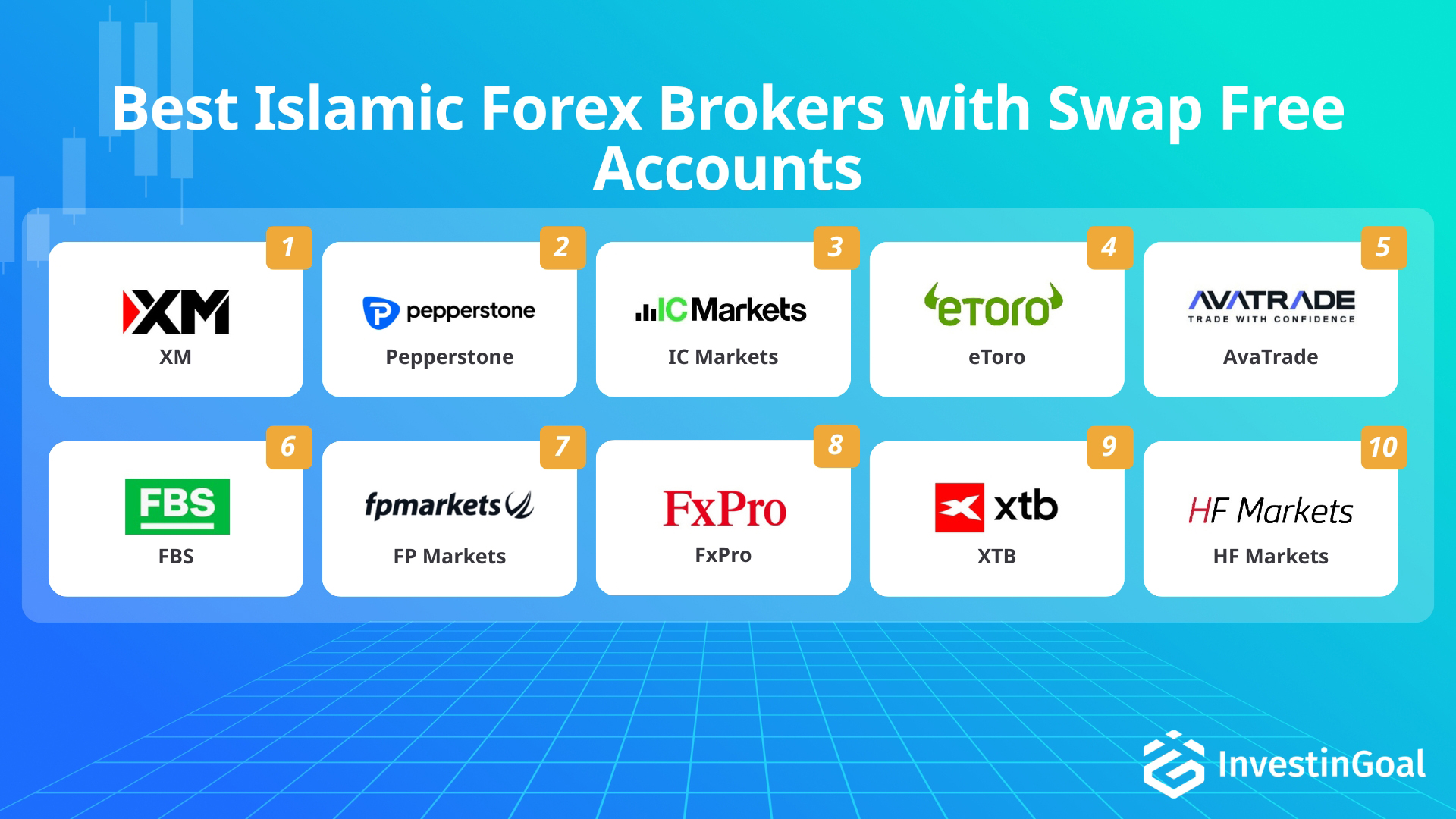

The best Forex brokers for Islamic (swap-free) accounts are XM, Pepperstone, IC Markets, and eToro.

The most important criteria to consider when choosing the best Forex broker for Islamic (swap-free) accounts are authentic Sharia compliance with transparent, non-interest fee structures, strong regulation and client protections, total trading costs (spreads/commissions/admin fees), and platform choice plus account accessibility (minimum deposit, leverage, demo, and product scope/restrictions).

XM is the best Islamic (swap-free) accounts Forex broker overall, thanks to providing authentic Sharia-compliant swap-free trading with no hidden interest-based fees, strong multi-jurisdiction regulation and client protections, very competitive overall trading costs, and flexible MT4/MT5 platforms with accessible account conditions and high leverage where allowed.

Ranked just behind XM, the best Islamic (swap-free) accounts Forex brokers for these criteria include Pepperstone, IC Markets, and eToro. Pepperstone provides a swap-free Standard account with no swaps and a fixed admin fee only if a position is held beyond five days (e.g., $100/lot on FX/metals), along with top-tier regulation and access to MT4, MT5, and cTrader (with TradingView connectivity on Razor accounts). IC Markets features swap-free Raw and Standard accounts with transparent per-night holding fees and ultra-tight spreads across MT4, MT5, cTrader, and TradingView. eToro includes an Islamic option with a one-time fixed administrative fee instead of daily swaps, very broad market coverage on its proprietary social-trading platform, and straightforward activation after a $1,000 deposit.

Some of the leading Islamic-friendly brokers mentioned here, such as Pepperstone, IC Markets, and eToro, are also recommended Forex brokers overall thanks to consistently low trading costs, fast execution, robust platforms, and strong customer support.

XM

(Best Islamic account Forex broker overall)

XM is the best Forex broker with an Islamic account thanks to a swap-free structure with no extra fees or widened spreads, a $5 minimum deposit, and up to 1:1000 leverage with negative balance protection. XM is an exceptional choice for fully halal overnight holdings. It charges no interest or administrative markups, so positions can remain open indefinitely without riba (interest in financial transactions) and without any hidden increase in spreads over time. XM’s zero-swap, zero-markup policy protects Islamic traders from riba and unexpected overnight costs by ensuring that all expenses are fully reflected in the visible spread when the trade is opened.

-

Regulations:

-

Avg. EUR/USD Spread:

-

Platforms:

XM Features

The features of XM are listed below.

- XM Islamic account removes overnight swaps and does not add extra fees or widen spreads to compensate.

- XM Islamic account allows all instruments and strategies without restrictions.

- XM supports MT4 and MT5 for Islamic accounts with full EA support.

- XM minimum deposit is $5 on Micro and Standard accounts.

- XM offers leverage up to 1:1000 with negative balance protection for Islamic accounts.

- XM EUR/USD spread is about 0.1 pips on Ultra Low or Zero and around 1.0 pip on Standard Islamic with no commission.

XM Pros and Cons

Advantages of XM

The advantages of XM are listed below.

- There’s a wide range of account types

- The demo account at XM is unlimited

- Wide range of educational resources

Disadvantages of XM

The disadvantages of XM are listed below.

- No social trading features available

- The account availability changes depending on the location of the trader

- High minimum deposit to invest in securities ($10000 for the XM Shares account)

About XM

XM is a global forex and CFD broker founded in 2009, offering trading on currencies, commodities, indices, stocks, and cryptocurrencies. XM provides MetaTrader 4, MetaTrader 5, and proprietary platforms. XM is regulated by multiple authorities including CySEC, ASIC, and IFSC. XM is known for competitive spreads, extensive educational resources, and multilingual customer support. XM serves over 5 million clients from 196 countries. XM offers various account types and a no-requote policy.

Pepperstone

(Best Islamic account Forex broker for short-term trading)

Pepperstone is the second best Forex broker with an Islamic account thanks to a transparent 5-day swap-free period (then a fixed $100/lot admin fee on FX/metals), 1.0–1.2-pip EUR/USD pricing on the Standard account, and full support for MT4/MT5/cTrader/TradingView. Pepperstone is an exceptional option for short-term Muslim traders. The first five swap-free days provide optimal conditions for day trading and swing strategies, and they allow scalping, hedging, and the use of EAs without any overnight interest being charged. Pepperstone’s 5-day swap-free period and fixed post-day-5 fee protect traders from riba and remove uncertainty around rollover costs by replacing variable swaps with a clearly defined flat charge on long-term positions.

-

Regulations:

-

Avg. EUR/USD Spread:

-

Platforms:

Pepperstone Features

The features of Pepperstone are listed below.

- Pepperstone Islamic Standard removes swaps and applies a fixed $100 per lot administration fee from day 6 on FX and metals positions.

- Pepperstone Islamic account availability is limited to eligible countries, mainly in Muslim majority regions.

- Pepperstone supports MT4, MT5, cTrader, and TradingView on Islamic accounts.

- Pepperstone suggests about $200 initial funding, and the Islamic Standard expects about $200 Australian dollars as a starting balance.

- Pepperstone EUR/USD spread on the Islamic Standard is about 1.0 to 1.2 pips with no commission.

- Pepperstone is regulated by ASIC, FCA, CySEC, DFSA, SCB, and CMA.

Pepperstone Pros and Cons

Advantages of Pepperstone

The advantages of Pepperstone are listed below.

- Stable raw spreads (0,10 pips on EUR/USD on average)

- Caters for algorithmic trading

- Has won over 30 Forex industry awards

Disadvantages of Pepperstone

The disadvantages of Pepperstone are listed below.

- The demo account is not unlimited

About Pepperstone

Pepperstone is a global forex and CFD broker founded in 2010 in Melbourne, Australia. Pepperstone offers trading on currencies, commodities, indices, stocks, and cryptocurrencies through MetaTrader and cTrader platforms. Pepperstone is regulated by multiple authorities including ASIC, FCA, and CySEC. Pepperstone is known for competitive spreads, fast execution, and extensive educational resources. Pepperstone serves clients in over 160 countries worldwide. The Pepperstone CEO is Tamas Szabo.

IC Markets

(Best low-cost Islamic account Forex broker)

IC Markets is the third best Forex broker with an Islamic account due to flat nightly fees that replace swaps (e.g., about $3 per lot on EUR/USD), Raw spreads from 0.0–0.1 pip plus $7/lot commission, and access to MT4/MT5/cTrader/TradingView platforms. IC Markets is an exceptional option for cost-focused halal traders. Its Islamic account keeps ECN-style pricing, replaces interest with fixed per-night fees, and minimizes trading costs efficiently by preserving the same tight spreads available on standard Raw accounts. IC Markets’ flat-fee model helps traders to avoid riba and maintain overnight costs predictable and transparent, since each instrument has a published fee that does not change with market interest rates.

-

Regulations:

-

Avg. EUR/USD Spread:

-

Platforms:

IC Markets Features

The features of IC Markets are listed below.

- IC Markets Islamic accounts remove swaps and charge a flat nightly holding fee that is instrument-specific.

- IC Markets Islamic fee on EUR/USD is about $3 per lot per night as a published example.

- IC Markets keeps spreads and commissions unchanged for Islamic clients.

- IC Markets Raw Spread Islamic averages 0.1 pips on EUR/USD plus $7 per lot round turn commission.

- IC Markets Standard Islamic averages about 0.6 to 0.8 pips with no commission.

- IC Markets minimum deposit is $200, and regulations include ASIC and CySEC among others.

IC Markets Pros and Cons

Advantages of IC Markets

The advantages of IC Markets are listed below.

- Low-latency trading environment

- Institutional level liquidity

- MT4, MT5, cTrader platforms are all available

Disadvantages of IC Markets

The disadvantages of IC Markets are listed below.

- Small amount of educational tools for new traders

- Small range of tradable assets compared to other CFD/Forex brokers

About IC Markets

IC Markets is a global forex and CFD broker founded in 2007 and based in Sydney, Australia. IC Markets offers trading on over 2,250 instruments including currencies, commodities, indices, stocks, and cryptocurrencies. IC Markets provides MetaTrader 4, MetaTrader 5, and cTrader platforms. IC Markets is regulated by multiple authorities including ASIC and CySEC. IC Markets is known for its ECN execution model and low spreads. The IC Markets CEO is Andrew Budzinski.

eToro

(Best Islamic account Forex broker for copy trading)

eToro is the fourth best Forex broker with an Islamic account thanks to an interest-free model that uses a one-time fixed administrative fee on CFD trades, a $1,000 minimum deposit to activate Islamic status, and copy trading support. eToro is an outstanding option for social investors. The fixed and non-accruing charges remove daily interest and allow halal trading via CFDs across popular markets (Forex, indices, stocks, cryptocurrencies), regardless of how many days a position is held. eToro’s fixed-fee structure protects traders from compounded overnight interest and hidden rollover charges by showing the total financing cost upfront at the moment the trade is opened.

-

Regulations:

-

Avg. EUR/USD Spread:

-

Platforms:

eToro Features

The features of eToro are listed below.

- eToro Islamic account removes overnight interest and uses a one-time administrative fee on applicable CFD trades disclosed upfront.

- eToro Islamic upgrade requires a minimum $1.000 deposit on a live account.

- eToro Islamic account uses the proprietary web and mobile platform and does not offer MT4 or MT5.

- eToro Islamic account provides access to more than 3,000 instruments with halal selection left to the trader.

- eToro EUR/USD spread typically ranges from 1.0 to 1.5 pips with a 1.0 pip minimum.

- eToro is regulated by CySEC, FCA, ASIC, and other authorities.

eToro Pros and Cons

Advantages of eToro

The advantages of eToro are listed below.

- Great copy trading and social trading features

- Wide range of asset classes

- It allows to buy fractional stocks from $10

Disadvantages of eToro

The disadvantages of eToro are listed below.

- The eToro spreads can be high

- Offers only USD accounts

- Transferring cryptocurrencies to other platforms can be hard

About eToro

eToro is a global multi-asset investment platform founded in 2007, offering trading on stocks, ETFs, Crypto CFDs, commodities, and forex. eToro provides a proprietary web and mobile platform with social trading features. eToro is regulated by multiple authorities including FCA, ASIC, and CySEC. eToro is known for its user-friendly interface, copy trading functionality, and commission-free stock trading. eToro serves over 30 million users worldwide. The eToro CEO and co-founder is Yoni Assia.

AvaTrade

(Best Islamic account Forex broker for fixed spreads)

AvaTrade is the fifth best Forex broker with an Islamic account thanks to daily administration fees that replace swaps, clear restrictions that disable crypto and some high-yield pairs on swap-free status, and typical EUR/USD spreads around 0.9 pip on standard pricing. AvaTrade’s clear instrument filters and daily administration fee model make it one of the excellent choices for Sharia-compliant trading. AvaTrade eliminates riba and keeps trading conditions transparent and efficient by replacing swap-based interest with clearly itemized daily administration fees on eligible instruments. The daily administration-fee model of AvaTrade helps traders avoid interest and quantify overnight holding costs precisely, making it easier to plan trades that might remain open for many days.

-

Regulations:

-

Avg. EUR/USD Spread:

-

Platforms:

AvaTrade Features

The features of AvaTrade are listed below.

- AvaTrade Islamic accounts remove swaps and apply a daily administration fee on overnight positions.

- AvaTrade Islamic accounts exclude cryptocurrencies and some high yielding currencies such as ZAR, TRY, RUB, and MXN.

- AvaTrade Islamic accounts apply slightly wider spreads on FX pairs to cover costs.

- AvaTrade supports MT4, MT5, WebTrader, AvaTradeGO, DupliTrade, and ZuluTrade for Islamic accounts.

- AvaTrade minimum deposit is $100 for Islamic accounts.

- AvaTrade EUR/USD spread is typically about 0.9 pips on standard accounts for Islamic clients with minor widening possible.

AvaTrade Pros and Cons

Advantages of AvaTrade

The advantages of AvaTrade are listed below.

- Tight fixed spreads from 0.6 pips (0.9 pips for retail traders)

- The mobile apps are well designed

- Can be connected to ZuluTrade and Duplitrade

Disadvantages of AvaTrade

The disadvantages of AvaTrade are listed below.

- High inactivity fees

- The demo account is limited to 30 days

About AvaTrade

AvaTrade is a global forex and CFD broker founded in 2006 and headquartered in Dublin, Ireland. AvaTrade offers trading on currencies, commodities, indices, stocks, bonds, ETFs, and cryptocurrencies. AvaTrade provides proprietary platforms alongside MetaTrader 4 and 5. AvaTrade is regulated by multiple authorities including CySEC, ASIC, and FSA. AvaTrade serves over 300,000 clients worldwide. AvaTrade is known for competitive spreads and extensive educational resources. The AvaTrade CEO is David Dryzin since 2016.

FBS

(Best Islamic account Forex broker for beginners)

FBS is the sixth best Forex broker with an Islamic account because of swap-free status on request for most account types and a $5 starting deposit. FBS is a great option for beginner Islamic Forex traders. Its low minimum deposit and halal setup let new traders focus on majors pairs (like EUR/USD or USD/JPY) without interest charges, so they only need to monitor spreads and any standard commissions. FBS’s swap-free option helps traders avoid riba in Sharia-compliant transactions and trade with transparent and easily understandable costs, because any fees are either built into the spread or disclosed in advance.

-

Regulations:

-

Avg. EUR/USD Spread:

-

Platforms:

FBS Features

The features of FBS are listed below.

- FBS offers swap free status on request and excludes some exotics, indices, and commodities such as crude oil.

- FBS Islamic accounts often avoid extra commissions with costs embedded in slightly higher spreads when applicable.

- FBS supports MT4, MT5, and the FBS Trader app for Islamic trading.

- FBS minimum deposit can be as low as $5 with Cent and Micro accounts allowing $1 to $5.

- FBS EUR/USD spread averages about 0.7 pips on the Standard account.

- FBS regulation includes CySEC and IFSC Belize with additional oversight noted.

FBS Pros and Cons

Advantages of FBS

The advantages of FBS are listed below.

- Low minimum deposit

- User-Friendly Platforms

- 90 international awards

Disadvantages of FBS

The disadvantages of FBS are listed below.

- Limited Financial Instruments

About FBS

FBS is a global forex and CFD broker founded in 2009, offering trading on currencies, commodities, indices, stocks, and cryptocurrencies. FBS provides MetaTrader 4, MetaTrader 5, and proprietary platforms. FBS is regulated by multiple authorities including CySEC, ASIC, and IFSC. FBS serves over 27 million clients in 150+ countries. FBS is known for low minimum deposits, extensive educational resources, and copy trading services.

FP Markets

(Best ECN Islamic account Forex broker)

FP Markets is the seventh best Forex broker with an Islamic account thanks to swap-free access on both Standard and Raw ECN accounts with per-night admin fees, true ECN pricing (Raw 0.0 pips + about $6/lot commission), and support for MT4/MT5/cTrader platforms. FP Markets is a strong choice for ECN-style halal execution since the Raw Islamic account retains near-zero spreads and uses a fixed overnight administration charge that replaces interest-based swaps. The swap-free ECN structure of FP Markets provides traders with transparent overnight costs with no riba, while still preserving key ECN advantages such as deep liquidity and fast market execution.

-

Regulations:

-

Avg. EUR/USD Spread:

-

Platforms:

FP Markets Features

The features of FP Markets are listed below.

- FP Markets Islamic accounts remove swaps and charge a fixed daily administration fee on overnight positions.

- FP Markets offers Islamic options on both Standard commission free and Raw commission based accounts.

- FP Markets minimum deposit is $100 or $100 Australian dollars for Islamic accounts.

- FP Markets supports MT4, MT5, and cTrader for Islamic clients.

- FP Markets Standard Islamic EUR/USD spread averages about 1.2 pips, while Raw offers 0.0 pips plus $6 per lot round turn commission.

- FP Markets regulation includes ASIC and CySEC with additional global entities.

FP Markets Pros and Cons

Advantages of FP Markets

The advantages of FP Markets are listed below.

- Broad Instrument Offering

- Competitive Spreads

- Multiple Trading Platforms

Disadvantages of FP Markets

The disadvantages of FP Markets are listed below.

- High Fees for International Withdrawals

- Outdated Platform Design

About FP Markets

FP Markets is an Australian-based global forex and CFD broker founded in 2005. FP Markets offers trading on over 10,000 instruments including forex, stocks, indices, commodities, and cryptocurrencies. FP Markets provides MetaTrader 4, MetaTrader 5, and proprietary platforms. FP Markets is regulated by multiple authorities including ASIC, CySEC, and FSA. FP Markets is known for tight spreads, fast execution, and extensive educational resources. The FP Markets CEO is Craig Allison.

FxPro

(Best Islamic account Forex broker for swing traders)

FxPro is the eighth best Forex broker with an Islamic account because of swap-free status across MT4/MT5/cTrader platforms, the possibility of an administrative fee only after extended holds, and flexible account types including Raw+ with near-zero spreads plus commission. FxPro is good for medium-term (swing trading) halal strategies without riba. With FxPro, most positions closed within about a week incur no overnight charges, which suits swing traders who typically hold trades for several days but not for many weeks or months. FxPro’s delayed-fee approach protects traders from immediate rollover interest and keeps the costs of maintaining positions short-term clear and predictable, because any administration fee is applied only after an extended holding period.

-

Regulations:

-

Avg. EUR/USD Spread:

-

Platforms:

FxPro Features

The features of FxPro are listed below.

- FxPro Islamic accounts remove overnight swaps and may apply alternative fees or slightly wider spreads.

- FxPro can apply an administrative fee for positions held beyond a set period often seven days.

- FxPro offers Islamic status on MT4, MT5, cTrader, and FxPro Edge.

- FxPro minimum deposit is $100 for live accounts.

- FxPro EUR/USD spread averages about 1.4 pips on standard accounts and raw pricing offers 0.0 to 0.3 pips plus commission.

- FxPro is regulated by FCA, CySEC, FSCA, DFSA, and SCB.

FxPro Pros and Cons

Advantages of FxPro

The advantages of FxPro are listed below.

- Regulated and Trusted Forex broker

- Diverse Trading Platforms

- Wide Range of Instruments

Disadvantages of FxPro

The disadvantages of FxPro are listed below.

- Inactivity Fee

- Limited Educational Resources

- No Guaranteed Stop-Loss Orders

About FxPro

FxPro is a global online broker founded in 2006, offering trading on forex, CFDs, stocks, indices, commodities, and cryptocurrencies. FxPro provides multiple trading platforms including MetaTrader 4, MetaTrader 5, cTrader, and its proprietary FxPro Platform. FxPro is regulated by multiple authorities including FCA, CySEC, SCB, FSC and KNN. FxPro serves clients in over 170 countries and has won numerous industry awards. The FxPro CEO is Charalambos Psimolophitis.

XTB

(Best Islamic account Forex broker for low deposits)

XTB is the ninth best Forex broker with an Islamic account thanks to a swap-free period on eligible instruments via XTB International, a low $1 minimum deposit, and Standard spreads that start from about 0.7 pips on EUR/USD. The swap-free period of XTB protects traders from riba during the allowed days and keeps costs limited to spreads and commissions that are part of the normal account pricing. The swap-free period of XTB places it among the very good choices for short and medium-term halal FX trading, thanks to the absence of interest that removes overnight charges, and to the fast execution and user-friendly tools of the xStation platform.

-

Regulations:

-

Avg. EUR/USD Spread:

-

Platforms:

XTB Features

The features of XTB are listed below.

- XTB Islamic swap free account removes swaps during an approved period with specified instrument scope.

- XTB may begin to apply fees on long held positions after a fixed number of nights.

- XTB Islamic account trades on the xStation 5 platform on web, desktop, and mobile.

- XTB minimum deposit is $1 for the international swap free account.

- XTB EUR/USD spread starts from about 0.7 pips on Standard Islamic and Pro Islamic offers raw spreads plus commission.

- XTB is regulated by FCA, KNF, CySEC, CNMV, DFSA, and IFSC Belize for the international entity.

XTB Pros and Cons

Advantages of XTB

The advantages of XTB are listed below.

- No minimum deposit

- Wide selection of assets

- Competitive trading costs

Disadvantages of XTB

The disadvantages of XTB are listed below.

- Small withdrawal fee

- No social or copy trading

- XTB demo account is limited to 30 days

About XTB

XTB is a global forex and CFD broker founded in 2002 and headquartered in Poland. XTB offers trading on over 2,000 instruments including currencies, stocks, indices, commodities, and cryptocurrencies. XTB provides the proprietary xStation platform and is regulated by multiple authorities including FCA, CySEC, and KNF. XTB is listed on the Warsaw Stock Exchange and serves over 897,500 clients worldwide. The XTB CEO is Omar Arnaout since March 2017.

HF Markets

(Best Islamic account Forex broker for day traders)

HF Markets is the tenth best Forex broker with an Islamic account thanks to a 7-day swap-free period across major account types, a $0 minimum on entry-level accounts, and competitive spreads (e.g., Premium 1.2 pips; Raw near-zero + commission). HF Markets is a good option for day and swing traders. Its full week without swaps accommodates most strategies before any flat administration fee may apply from day 8 onward on trades that remain open. HF Markets’ 7-day swap-free policy protects traders from riba on open positions for up to one week and limits longer-term costs to flat, pre-announced administration fees instead of fluctuating swap rates.

-

Regulations:

-

Avg. EUR/USD Spread:

-

Platforms:

HF Markets Features

The features of HF Markets are listed below.

- HF Markets Islamic accounts provide a seven day swap free grace period with a fixed administration fee from day eight.

- HF Markets does not widen spreads for Islamic clients and never charges interest.

- HF Markets supports MT4, MT5, a web terminal, and the HFM mobile app for Islamic accounts.

- HF Markets minimum deposit is $0 on entry accounts with Pro at $100 and Pro Plus at $250.

- HF Markets EUR/USD spread is about 1.2 pips on Premium with tighter costs on Pro and near zero on Zero plus commission.

- HF Markets is regulated by FCA, CySEC, DFSA, FSCA, CMA, and other authorities.

HF Markets Pros and Cons

Advantages of HF Markets

The advantages of HF Markets are listed below.

- High Leverage Options

- Low Minimum Deposit

- Wide Range of Trading Instruments

Disadvantages of HF Markets

The disadvantages of HF Markets are listed below.

- Higher Trading Costs

- Limited Educational Resources

About HF Markets

HF Markets, formerly known as HotForex, is a global multi-asset broker founded in 2010. HF Markets offers trading on forex, stocks, commodities, indices, and cryptocurrencies through MetaTrader platforms. HF Markets is regulated by multiple authorities including CySEC, FCA, DFSA, and FSCA. HF Markets serves clients worldwide and is known for competitive trading conditions and extensive educational resources. HF Markets recently rebranded to emphasize its expanded product range. The HF Markets Group CEO is George Koumantaris.

Comparison of the best forex brokers with islamic account

The table that compares the best forex brokers with islamic account is shown below.

| Broker | Minimum deposit for Islamic account (USD) | Regulatory oversight (main licences) | Islamic administrative fee model | Islamic asset restrictions | Typical EUR/USD spread on Islamic standard account (pips) |

|---|---|---|---|---|---|

| XM | $5 | CySEC, ASIC, DFSA, FSC Belize | No admin fee | No stated restrictions | 1.0 pips |

| Pepperstone | $140 | ASIC, FCA, CySEC, DFSA, SCB, CMA | $100/lot after 5 days | No stated restrictions | 1.0–1.2 pips |

| IC Markets | $200 | ASIC, CySEC, FSA Seychelles, SCB Bahamas, CMA Kenya | Fixed per-night fee (e.g. $3/lot on EUR/USD) | No stated restrictions | 0.6–0.8 pips |

| eToro | $1,000 | CySEC, FCA, ASIC | One-time upfront fee per trade | No stated restrictions | 1.0–1.5 pips |

| AvaTrade | $100 | CBI (Ireland), ASIC, FSCA, FFAJ, FSC BVI, KNF | Daily admin fee | No crypto; some high-yield FX blocked | 0.9–1.0 pips |

| FBS | $5 | CySEC, IFSC Belize, ASIC, FSCA | No stated admin fee (instrument-dependent) | Exotics, some indices and energies excluded | 1.0 pips |

| FP Markets | $100 | ASIC, CySEC, FSCA, CMA | Fixed daily admin fee on overnight positions | No stated restrictions (majors/metals/indices allowed) | 1.2 pips |

| FxPro | $100 | FCA, CySEC, FSCA, DFSA, SCB | Possible admin fee after extended holds (e.g. ≥7 days) | No stated restrictions | 1.4 pips |

| XTB | $1 | FCA, KNF, CySEC, DFSA, IFSC Belize | No swaps during limited swap-free period; fee may apply after | Limited instrument list; time-limited swap-free | 0.7–1.0 pips |

| HF Markets | $0 | FCA, CySEC, DFSA, FSCA, CMA | No swaps for 7 days; fixed fee from day 8 | Some exotics/special instruments may be excluded | 1.2 pips |

Warning

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money.

The best swap-free Islamic Forex broker is eToro. eToro uses an interest-free Islamic model with a one-time fixed administrative fee instead of swaps, requires a $1,000 minimum deposit to activate the Islamic account, and gives traders full copy-trading support for building halal portfolios. This combination of a clear non-interest fee structure, a defined funding threshold and powerful copy-trading tools helps practicing Muslim traders avoid riba, plan their capital requirements and mirror diversified Sharia-compliant strategies more easily.

For swap-free Islamic Forex trading, transparent fixed fees in place of swaps, competitive spreads and robust multi-platform access are the main qualities that set strong brokers apart. IC Markets is an attractive alternative to eToro thanks to its Islamic account with flat nightly fees that replace swaps to avoid riba, ECN-style raw spreads from 0.0–0.1 pip plus low commission, and support for MT4, MT5, cTrader and TradingView for cost-efficient halal trading. AvaTrade likewise serves as a solid substitute for eToro because it offers an Islamic account that replaces swaps with clearly itemised daily administration fees, typical EUR/USD spreads around 0.9 pip on standard pricing, and clear instrument filters that exclude non-compliant crypto and high-yield pairs, making it easier to keep both costs and Sharia compliance under control.

The best Islamic Forex broker with the lowest spread is eToro. eToro combines typical 1.0-pip EUR/USD spreads on its CFD platform with an Islamic setup that uses a one-time fixed administrative fee instead of daily swaps, while also integrating CopyTrader to help build diversified low-spread Islamic portfolios. These tight core spreads, the simple non-interest administrative fee and the social copy-trading functionality enable Muslim traders to keep trading costs down, avoid overnight interest and easily follow successful low-spread strategies within a halal framework.

Among Islamic brokers that focus on tight pricing, ultra-low raw spreads, transparent swap-free fee arrangements and stable execution conditions are crucial advantages for spread-sensitive traders. IC Markets is a compelling alternative to eToro because it offers raw EUR/USD spreads around 0.0–0.1 pip with a $7 round-turn commission, an Islamic account where swaps are replaced by small fixed per-night charges per instrument, and deep-liquidity no-dealing-desk execution that suits tight-spread scalping and algorithmic strategies, making it one of the more attractive low spread FX brokers for Islamic traders. AvaTrade is another option alongside eToro, since it provides a fixed EUR/USD spread around 0.9 pips with no commission, an Islamic account that removes interest through transparent daily admin fees, and MT4/MT5 plus AvaTradeGO platforms that combine swap-free pricing with predictable overall trading costs.

The best Islamic Forex broker with MT4 is HF Markets. HF Markets offers Islamic accounts with a 7-day swap-free period on major MT4 account types before any flat admin fee applies, a choice of MT4 Cent, Pro and Zero Spread accounts to match position size and pricing style, and access to Premium Trader Tools plus Autochartist and HFCopy integrated into MT4 for analysis and copy trading. This mix of temporary swap-free protection, flexible MT4 account structures and advanced analysis and copy-trading add-ons allows Muslim traders to tailor their trading conditions, minimise interest exposure and enhance decision-making directly within the familiar MT4 environment.

For Islamic MT4 trading, having swap-free or reduced-swap conditions, accessible account minimums and strong educational or social features are key qualities of the top brokers. FBS is a noteworthy alternative to HF Markets thanks to its mobile support for Islamic traders, swap-free status available on request for most MT4 account types to remove overnight interest, very low minimum deposits from about $5 on Cent and Standard MT4 accounts, and MT4-friendly education which places it among top MT4 Forex broker. AvaTrade also stands as a viable substitute for HF Markets, as it offers an Islamic MT4 account that replaces swaps with clearly itemised daily admin fees on eligible instruments, fixed and easy-to-understand MT4 spreads around 0.9-pip on EUR/USD for cost predictability, and strong regulation plus copy-trading and research integrations on MT4 and MT5 that support disciplined, halal-compliant trading.

The best Islamic Forex broker for beginners is AvaTrade. AvaTrade provides comprehensive beginner education through tutorials, webinars and e-books, runs an Islamic account that removes swaps and instead uses transparent daily administration fees, and offers an intuitive multi-platform setup (MT4, MT5, WebTrader and AvaTradeGO) with an accessible starting deposit of about $100. This blend of structured learning resources, a clear swap-free fee model and user-friendly platforms with low entry capital helps new Muslim traders build skills, stay Sharia-compliant and start trading without needing a large initial investment.

When it comes to Islamic brokers suited to novices, rich educational content, gentle minimum deposit requirements and straightforward swap-free configurations are the main ingredients that support a smooth learning curve. XTB is a good alternative to AvaTrade because it offers a swap-free period on eligible FX instruments via XTB International for interest-free early trading, an intuitive xStation 5 platform with built-in guidance, tooltips and educational videos for beginners, and a very low minimum deposit from about $1 with Standard EUR/USD spreads starting near 0.7 pips. Pepperstone likewise rivals AvaTrade for Islamic beginners, since it provides an Islamic account with a transparent five-day swap-free period followed by a fixed admin fee instead of variable swaps, no required minimum deposit and beginner-friendly platforms across MT4, MT5, cTrader and TradingView, plus strong education and support that position it among leading Beginner FX brokers for Muslim traders seeking solid risk management.

The best Islamic Forex trading app is AvaTrade. AvaTrade combines a swap-free Islamic account with clearly itemised daily admin fees and a filtered instrument list for Sharia compliance, the AvaTradeGO mobile app that delivers Trading Central signals directly into trade tickets, and additional AvaProtect, AvaOptions and AvaSocial apps that add loss protection, options hedging and social trading on mobile. These Sharia-compliant account conditions, integrated research signals and specialised mobile tools for hedging, protection and social interaction give Muslim traders a powerful and convenient way to manage and grow their Forex positions from their phones.

For Islamic Forex trading on mobile, a compliant swap-free structure, strong social or copy-trading features and responsive multi-platform apps are particularly valuable attributes. eToro is a prominent alternative to AvaTrade thanks to its Islamic model that uses a one-time fixed administrative fee per CFD trade instead of ongoing swaps, its social-first mobile app with CopyTrader and CopyPortfolios for hands-off diversified Forex exposure, and a $100,000 virtual portfolio in-app that lets traders practise strategies alongside their live Islamic account. Pepperstone also provides a compelling option for those who want to compare the best Forex trading apps like AvaTrade, because it offers an Islamic account with five days of swap-free MT4, MT5, cTrader and TradingView trading before any flat admin fee applies, a multi-platform mobile line-up with synced watchlists and alerts, and advanced execution tools like one-tap “close all” and drag-and-drop orders that appeal to active halal traders on the go.

The criteria to choose the best Islamic forex broker depend on regulatory compliance with Shariah law and competitive trading conditions. Islamic forex brokers must eliminate interest-based transactions while providing efficient market access.

The criteria to choose the best Islamic forex broker are listed below.

- Swap-free availability: Verify the broker offers swap-free accounts across all major account types, such as standard accounts, micro accounts, and ECN accounts, to ensure compliance with Islamic trading principles.

- Minimum deposit requirements: Compare minimum deposit thresholds that range from $5 at XM to $1,000 at eToro, and select brokers that match your capital allocation strategy.

- Administrative fee structure: Examine fixed administration fees that brokers charge for positions held beyond specific timeframes, such as FBS charging fees after two days or Pepperstone applying fees after 10 days.

- Regulatory oversight: Choose brokers operating under recognized financial authorities that permit Islamic trading, such as CySEC, FCA, or ASIC jurisdictions that accommodate Shariah-compliant operations.

- Asset restriction policies: Review which financial instruments remain available under swap-free conditions, as many brokers restrict exotic currency pairs, cryptocurrencies, or specific indices for Islamic accounts.

- Trading platform access: Ensure the broker provides Islamic account compatibility with preferred trading platforms, such as MetaTrader 4, MetaTrader 5, or proprietary platforms that support automated trading strategies.

- Spread competitiveness: Analyze spread costs that start from 0 pips at brokers like FBS and IC Markets, while considering whether spreads increase for Islamic account holders compared to standard accounts.

- Demo account provision: Test Islamic trading conditions through demo accounts that brokers like XM and AvaTrade provide to allow traders to evaluate execution quality before committing real capital.

A forex broker’s Islamic account is truly swap-free when the broker explicitly states that no swaps or interest are charged on overnight positions. For example, IC Markets confirms its swap-free accounts “do not pay or earn swap or interest” on its official page. AvaTrade states that daily swaps are replaced by daily administration fees on Islamic accounts, meaning no interest. FP Markets describes its Islamic accounts as swap-free, noting that a handling charge may apply on some instruments.

Any forex broker’s Islamic account usually include anti-abuse clauses if it is genuine. IC Markets prohibits using a swap-free account “to make profits from not paying swaps” in its terms and conditions. XM bans profits derived from swaps in its Islamic terms. XM can remove swap-free qualification if your trading pattern indicates misuse, as stated on its help page.

Application and eligibility rules matter for a forex broker’s Islamic account. XM requires that swap-free status is only for clients who cannot use swaps for religious reasons. FP Markets details how Muslim clients provide proof when requesting swap-free status, which helps clarify what are Islamic accounts and how brokers apply these conditions in practice.

You compare spreads between Islamic and standard forex accounts by checking the underlying account type first, pulling official spread data, calculating your total entry cost, then adding overnight fees if you hold positions.

The underlying account determines your costs. Pepperstone builds its swap-free option on Standard pricing (wider spreads, no commission). IC Markets offers swap-free on both Raw Spread accounts (tight spreads plus commission) and Standard accounts (wider spreads, no commission). In forex trading, brokers earn mainly from the spread in Forex, which can be applied in different ways depending on the account type.

First, you calculate total entry cost per trade by converting spreads to dollars. Pepperstone Standard shows EUR/USD at 1.0-1.2 pips average, which equals roughly $11 per standard lot (each pip = $10). IC Markets Raw shows 0.1 pips plus $3.50 commission per side, which totals about $8 per round turn ($1 spread + $7 commission). The Raw account costs less per trade in this comparison. Then, you add overnight costs for positions you hold beyond intraday. Pepperstone charges administration fees after 5 days per position. Pepperstone shows handling fees starting from day 5 on many instruments. These fees can change which account type costs less depending on your holding period.

To understand if an Islamic Forex broker charges additional trading costs, check the broker’s Islamic account page for administration fees, holding fees, or handling fees that replace swaps. IC Markets applies a flat rate holding fee for overnight positions. AvaTrade transfers swaps into daily administration fees. AvaTrade charges handling fees on certain instruments.

Islamic Forex brokers sometimes widen spreads compared to their raw pricing. Pepperstone adds a 1-pip mark-up to its swap-free Standard account compared to Razor spreads.

Time-based admin fees start after holding positions for specific periods. Pepperstone charges an admin fee after 5 days per standard lot in some entities. The same broker charges every 10 days in its UK entity. HF Markets offers the first 3 nights free on many instruments before fees begin from the 4th night.

Costs on Islamic accounts might change based on instruments. XM applies Fair Value Adjustments on Metals and Energies. eToro charges a 10% yearly swap on crypto longs after a 5-day grace period. You should always read the broker’s pricing pages and legal PDFs to find these fees, as the Forex trading costs directly impact profitability. The information appears in fee schedules, cost disclosure documents, or Islamic terms and conditions.

To avoid limited-day swap-free offers in forex brokers, check the grace period length before forex brokers start charging administration fees on swap-free accounts. Pepperstone charges after 5 days in some entities, while Pepperstone’s UK entity charges every 10 days a position remains open. HF Markets offers the first 3 nights free on many instruments, then fees start from day 4.

Examine instrument-specific rules that forex brokers apply to swap-free accounts. Crypto positions at CFD crypto brokers may carry an annual swap on long positions. Some JPY/CHF crosses, metals, and other instruments have different fee schedules, and it’s important to understand it as Forex swap may vary with it.

Review revocation conditions that forex brokers include in their terms. XM and IC Markets reserve the right to remove swap-free status if they detect abuse patterns in your trading activity. Each forex broker defines “abuse” differently in their terms and conditions, so read what triggers revocation at your specific broker.

Islamic Forex brokers offer swap-free accounts on two main pricing structures. These are commission-based raw/ECN accounts and spread-only standard accounts. The choice affects your trading costs.

IC Markets provides swap-free options on Raw Spread accounts (tight spreads plus $3.50 commission per side) and Standard accounts (wider spreads, no commission). These work across MT4, MT5, and cTrader platforms. Pepperstone builds its swap-free offering on Standard pricing, which charges no commission but has approximately 1.0-1.2 pips on EUR/USD.

Tickmill allows you to convert Classic accounts (spread-only) or Raw accounts (commission-based) to Islamic option. XM offers the Islamic option across all its account types, including Micro, Standard, Ultra Low, and Zero accounts depending on your region. Swap-free accounts can belong to different categories, and it is ultimately the broker’s choice which Forex account types are offered with this option.

Islamic swap-free Forex brokers prohibit strategies designed to profit from not paying swaps. The most common banned tactic is carry-trade arbitrage, where traders hold positions primarily to gain from interest differentials in a swap-free setting.

For example, IC Markets explicitly names this as abuse that can lead to revocation and back-charges. Brokers like XM ban cash-back arbitrage and bonus arbitrage. These involve opening positions without genuine economic purpose to exploit swap-free terms. XM allows revocation and retroactive charges when it detects these patterns.

Islamic swap-free brokers flag fraud, manipulation, and excessive overnight inventory as abuse. HF Markets ties ongoing swap-free qualification to trading behavior and can remove the status if patterns suggest misuse. The brokers reserve the right to require justification for swap-free status.

Some instruments remain partially non-swap-free on Islamic accounts. Pepperstone charges a rate on crypto longs after a brief grace period. Traders should check instrument lists and fee tables before deploying any trading strategy to ensure compliance with the broker’s terms.